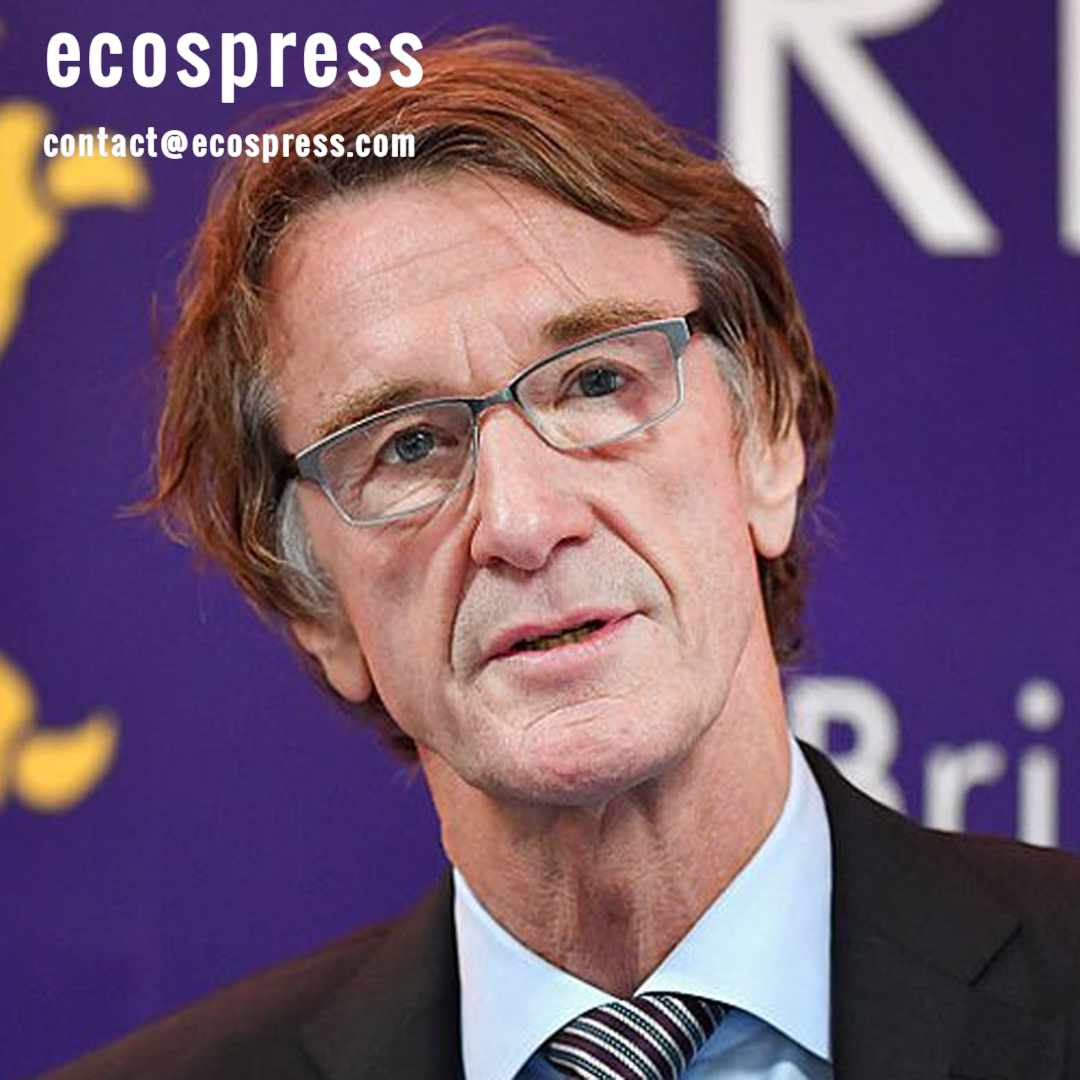

In recent years, the UK has witnessed a significant wave of billionaire migration, including prominent figures such as Sir Jim Ratcliffe, founder of Ineos, and James Dyson, the renowned inventor and entrepreneur. This phenomenon is growing and has a substantial impact on the British economy and society.

Main Reasons Behind Billionaire Migration from the UK

The reasons behind this migration are varied, as many of these billionaires see foreign environments as more attractive for their wealth and businesses. Reasons range from stringent tax policies to the search for more favorable economic environments and financial planning. According to a report by The Guardian, British tax policies have become stricter, prompting many wealthy individuals to leave the country (The Guardian, 2023). This shift highlights the deep challenges facing the UK in retaining its ultra-wealthy and attracting capital.

Tax Policies and Their Impact on Billionaire Migration

One of the main reasons for this migration is changes in tax policies. The UK government has increased taxes on the wealthy to 45% on income exceeding £150,000 per year, as reported by the BBC regarding rising tax rates in the UK (BBC, 2023), in an attempt to raise more financial resources to support public services and the national economy after the COVID-19 pandemic.

Additionally, capital gains taxes of up to 28% have been imposed, leading many billionaires to reconsider the economic benefits of staying in the UK. Such changes have particularly affected individuals like Jim Ratcliffe and James Dyson, who chose to leave the UK in search of more stable and favorable environments.

These policies have not appealed to many billionaires, who believe that the high tax rates reduce investment incentives and encourage them to move their wealth to countries with less stringent tax policies, such as Switzerland or Monaco. Thus, the departure of these billionaires is not just about high taxes but also about maintaining privacy and financial security.

Economic Impact of Billionaire Migration on the UK

The consequences of this migration are not limited to the loss of capital but extend to impact the entire British society. According to a report by the Financial Times, the departure of billionaires significantly affects the British economy by reducing investment opportunities and tax revenues (Financial Times, 2023).

When billionaires leave, the UK loses substantial investment opportunities, whether in the real estate sector or in startups that typically benefit from their investments. Additionally, the departure of the wealthy means a loss of tax revenues that were used to fund infrastructure and public services, potentially leading to additional economic pressures on the government and citizens.

Declining Attractiveness of the UK as an Investment Destination

This migration may also affect the UK’s image as an attractive destination for the wealthy and investors. The declining attractiveness of the UK opens the door for other countries to enhance their position as appealing investment destinations, which could result in a long-term competitive loss. Conversely, the UK needs to consider new strategies to attract the wealthy back, such as offering new tax incentives or improving the overall investment environment.

Future Challenges and Proposed Solutions

In conclusion, the migration of billionaires from the UK is an alarm for the government and society as a whole about the importance of creating a balanced environment that combines social justice and capital attraction. Finding this balance will be the biggest challenge facing the UK in the coming years to ensure it remains a favored destination for business and investment.

Trusted Sources:

- The Guardian (2023)

- BBC (2023)

- Financial Times (2023)

Farid Maamar

unreasonable 😮😮😮